Our Funds

DH Investment Property Fund

- Established: 9 March 2023

- Private Equity, Total AUM: USD 270 million as of 31 December 2024

The DH Investment Property Fund has successfully acquired Queenston Investment Limited (“均德投资”), the primary holding company of two commercial properties located in the emerging district of Tuen Mun, New Territories, Hong Kong. These properties are strategically positioned near the MTR station and bus terminal. Tuen Mun benefits from its central location within the Hong Kong-Zhuhai-Macao Greater Bay Area and boasts excellent connectivity to Hong Kong’s local railway system and road networks, ensuring convenient and efficient transportation options.

DH Property Fund

- Established: 14 December 2022

- Private Equity, Total AUM: CNY 650 million as of 31 December 2024

DH Property Fund currently has a portfolio of 2 assets across cities in China:

- Suzhou

The first project is a prime industrial land located in Shaxi Town, Taicang City. Taicang, a prominent industrial manufacturing city under Suzhou’s jurisdiction, boasts a robust industrial structure with a high concentration of advanced manufacturing and foreign-invested enterprises. Strategically situated just an hour’s drive from Shanghai, Taicang plays a pivotal role in China’s Yangtze River Delta Integration Plan, fostering urban-rural integration and accelerating the growth of high-tech industries.

- Wuxi

The second project is located in the Huishan Economic Development Zone, Wuxi City, Jiangsu Province, China. Spanning approximately 51.59 acres with a built-up area of 42,000 square meters and a plot ratio of 2.158, the development comprises two two-story buildings for production and warehousing, along with two auxiliary structures. Wuxi Huishan serves as a strategic hub for large-scale, well-capitalized enterprises, leveraging its advantageous location and thriving e-commerce, cold chain logistics, and manufacturing ecosystems.

DH Cornerstone Fund

- ISIN No: SGXZ24816167

- Established: 10 October 2024 (Reissue)

- Hedge Fund, Total AUM: USD 76.85 million as of 26 August 2025

DH Cornerstone Fund has an investment objective to provide investors with low-risk, high-return opportunities, including from the cryptocurrency market. The fund’s investment strategy consists of three low-risk and stable strategies: term structure arbitrage, market-making, and high-frequency trend trading. This fund uses systematic algorithms to monitor and manage risks around the clock, remaining resilient to market fluctuations and striving to achieve stable, low-risk, high-return income for investors.

DH Global Investment

- Established: 15 August 2024 (Reissue)

- Multi Strategy Fund, Total AUM: USD 14.82 million as of 31 December 2024

DH Global Investment is a versatile, multi-asset fund designed to deliver robust, diversified returns by investing across an array of asset classes globally. With a portfolio that includes listed fixed income and equity securities, foreign exchange and private credit, the Fund taps into both traditional and alternative investment avenues to harness growth and stability across global markets. This fund leverages dynamic asset allocation, adjusting to market conditions and investment opportunities to maximize returns while managing risk.

DH Infinity Assets

- Established: 25 August 2022

- Fund of Fund, Total AUM: USD 72.75 million as of 28 March 2025

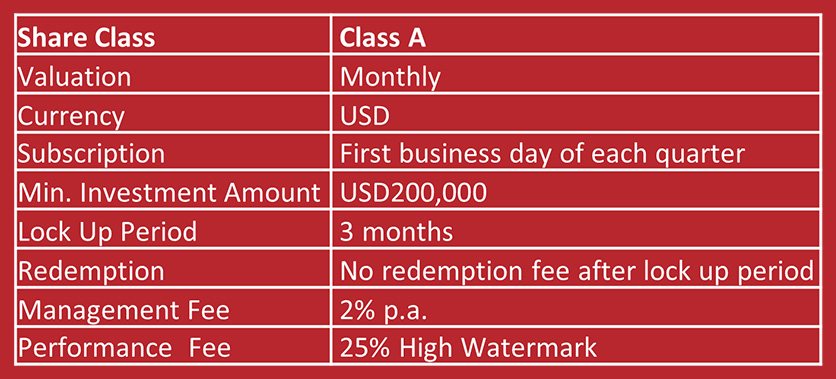

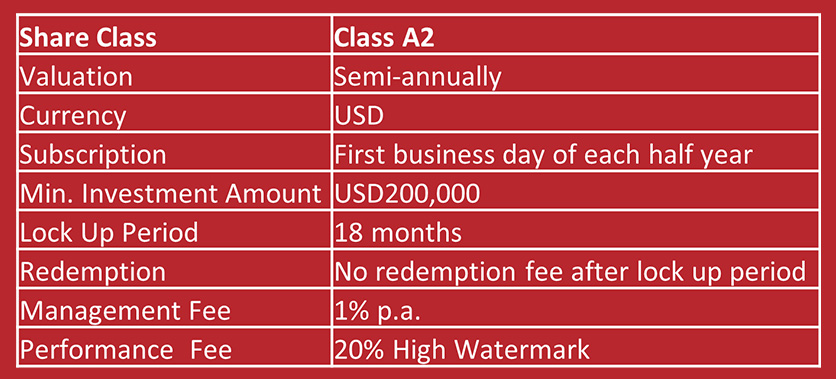

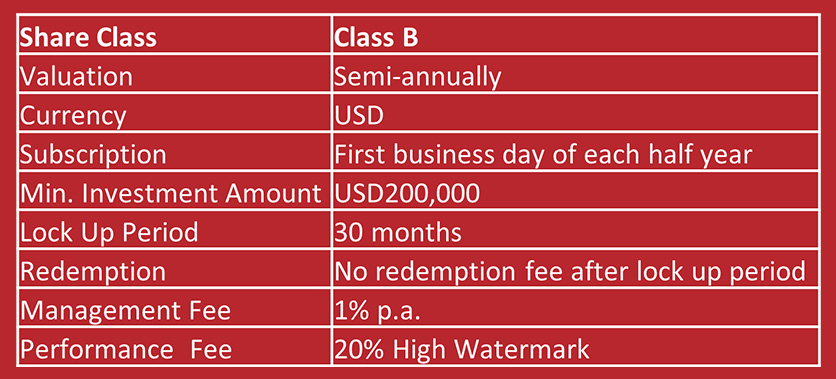

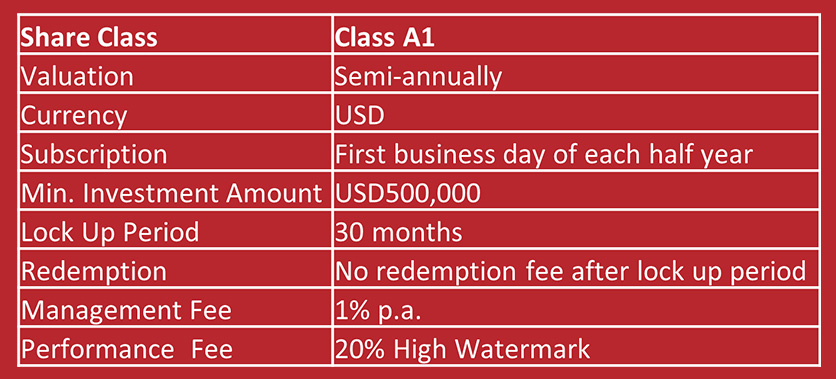

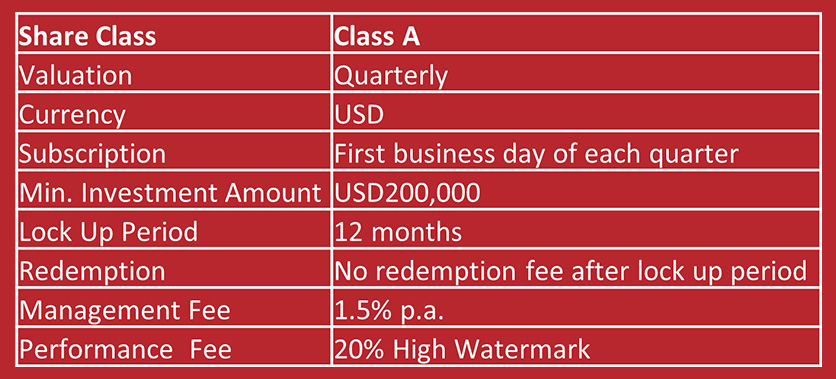

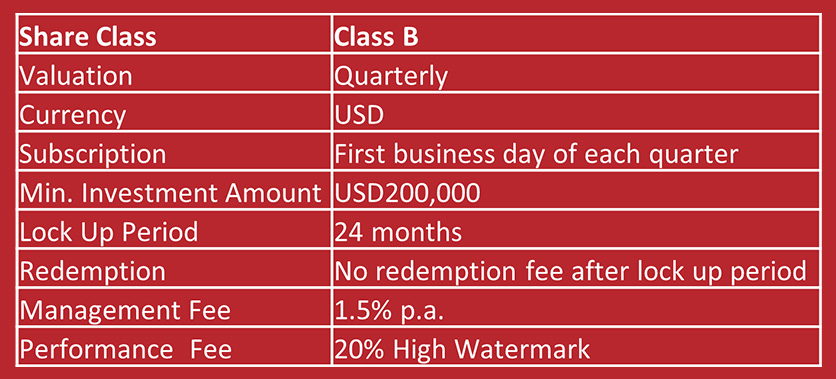

DH Infinity Assets employs a strategic Fund of Funds approach, targeting returns from a curated selection of alternative investments. This structure provides diversified access to various funds across various asset classes, maximising growth potential while managing risk. DH Infinity Assets is designed with flexibility in mind, offering different classes of shares tailored to meet the preferences of both conservative clients and those seeking higher-risk, higher-reward opportunities. Through expert management and targeted exposure to alternative markets, DH Infinity Assets delivers a refined pathway for investors aiming to balance growth, stability, and risk in their portfolios.

Start Your Financial Journey with DH Wealth Today!